Refund to a Cancelled Credit Card Explained

Confused about a refund to a cancelled credit card? This guide explains how the process works and what steps to take to get your money back.

Confused about a refund to a cancelled credit card? This guide explains how the process works and what steps to take to get your money back.

Yes, you can absolutely get a refund to a cancelled credit card. It's a common worry, but thankfully, the financial system is built to handle this exact situation.

Even though your physical card is long gone, the bank account it was connected to is usually still active. Payment networks like Visa and Mastercard are smart enough to route the money directly to that account, not the piece of plastic you shredded.

In the rare case that you've closed the entire bank account, the bank will typically just mail you a paper check. Your money isn't lost in limbo.

So, you returned that online purchase, but the credit card you used is now cancelled. What happens next? Don't panic. The key thing to remember is that your credit card and your bank account are two separate things.

When a merchant issues a refund, they don't need your new card details. They simply push the funds back through the original transaction's pathway. The account identifier from your old card still exists in the banking system, and it acts like a homing beacon for your refund.

Think of it like mail forwarding. When you move, the post office can still redirect your letters to your new address. Your bank does something similar, redirecting the incoming refund to the correct account tied to that old card number.

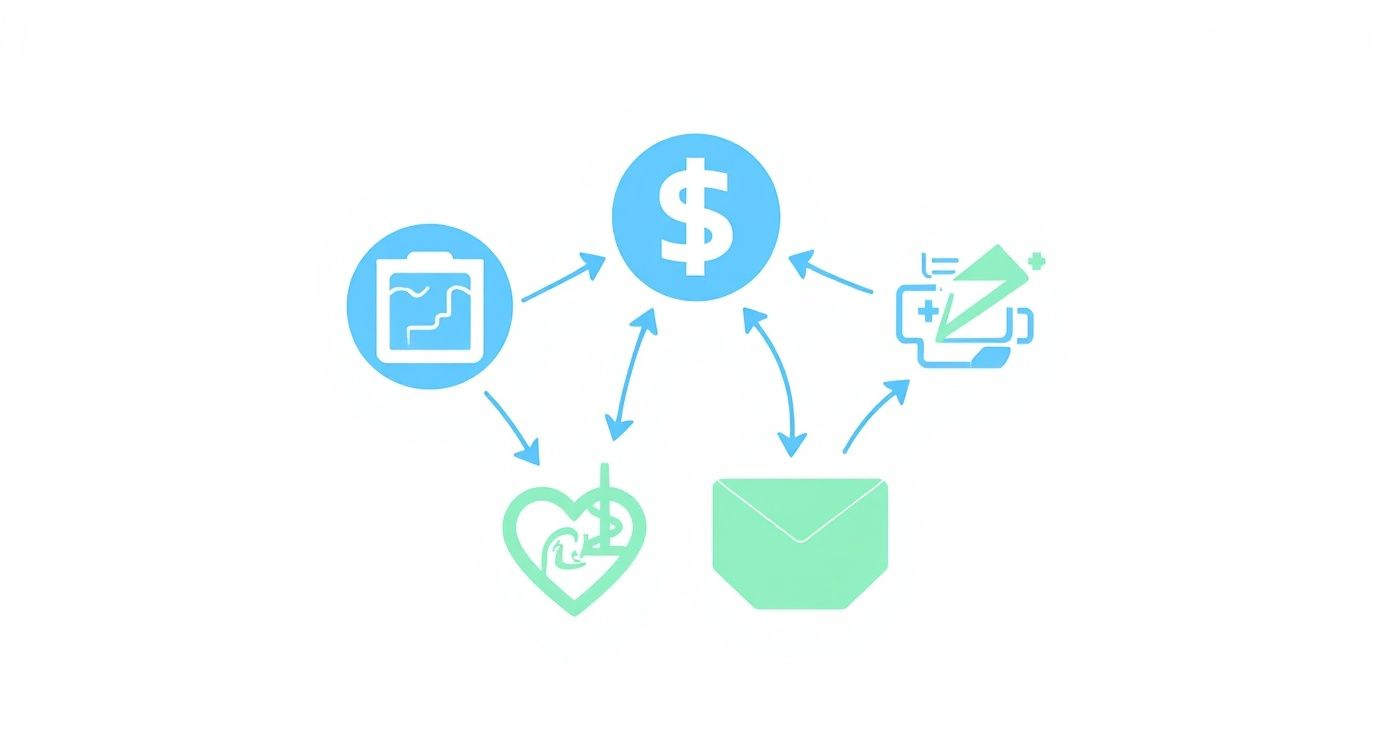

This decision tree gives you a quick visual of how it all works.

As you can see, the only real fork in the road is whether your underlying bank account is still open.

This process is a lifesaver, especially when you consider that the global cost of retail returns has ballooned to an eye-watering $890 billion. A huge chunk of those returns involves cards that have since expired or been cancelled. If the bank account itself is totally closed, the merchant has to figure out another way to pay you back.

To give you a clearer idea, here's a simple breakdown of the most common outcomes.

This table breaks down the likely outcomes when a refund is sent to a cancelled card based on your account status.

Ultimately, patience is your best friend here. The system works, but it might take a few extra days.

The most important takeaway is that the link between the old card number and your bank account often remains intact long enough for refunds to process successfully. Patience is key, as it might take a few extra business days.

This is a familiar headache for anyone managing a lot of transactions, like crowdfunding creators. Fortunately, specialized platforms can make this much easier. For example, you can learn more about how to accept payments in PledgeBox, which offers tools designed to handle these kinds of complex payment situations smoothly.

When you're waiting on a refund but the original credit card is long gone, you can't just cross your fingers and hope for the best. Being proactive is the key to avoiding a long, drawn-out headache and getting your money back faster. Your first move? Get in touch with the merchant, especially if you know the refund is already in motion.

A quick phone call or email to let them know the card on file is cancelled gives their accounting team a heads-up. This one simple step can stop your refund from getting stuck in digital purgatory. It signals that you're on top of things and helps them route the money correctly from the get-go.

While you wait, keep a sharp eye on the bank account that was tied to your old credit card. This is where the refund will most likely land. Most refunds hit your account within 7-10 business days, but the extra step of rerouting funds from a closed card can sometimes tack on a small delay.

If two weeks have gone by and your money is still MIA, it’s time to pick up the phone. Your next call should be to the bank or credit union that issued the original card.

Having all your ducks in a row before calling your bank is a game-changer. It can turn a potentially frustrating, hour-long call into a quick, five-minute fix. Be ready to prove who you are and have the transaction details on hand.

When you connect with the bank, you'll want this information ready:

Once you have a representative on the line, state your case clearly and concisely. You can open with something like, "Hi, I'm expecting a refund from [Merchant Name] for a purchase I made on [Date], but it was processed to my old credit card, which has been cancelled."

This opening line gives the agent everything they need to start digging. From there, they can trace the transaction, see if the money is held up somewhere, or confirm it landed safely in your linked bank account.

Following these steps creates a clear trail for everyone involved, making it much easier for both the merchant and the bank to get your refund to a cancelled credit card back where it belongs.

So, what happens if the bank account tied to your old credit card is also closed? In that case, a direct refund is pretty much impossible. The bank will simply reject the transaction, and the money will bounce right back to the merchant. This can leave you in a bit of a tricky spot.

When this happens, the merchant is still on the hook to get you your money, but they'll need to find another way. Don't be surprised if they offer you store credit first—it's the easiest option for them and keeps the cash in their business. But remember, you don't have to accept it if that doesn't work for you.

You'll likely be presented with a few choices, each with its own pros and cons. Be ready to chat with them about what works best for your situation.

Here are the most common alternatives you'll come across:

Your best bet is to clearly and politely explain your situation to the merchant. Just let them know your original account is closed and tell them what alternative you'd prefer. Most businesses will work with you to find a reasonable solution.

When traditional refund channels are a dead end or if the original payment was made through a service like PayPal, knowing how to handle a dispute becomes even more critical. It's worth getting familiar with the ins and outs of managing PayPal chargeback disputes, as this can give you an extra layer of protection if communication with the merchant breaks down.

Ever wonder why a merchant seems a bit hesitant when you ask for a refund to a cancelled card? It's not that they don't want to help. From their side of the counter, these situations are a minefield of administrative headaches and genuine financial risk.

Processing a refund to an inactive card isn't a simple one-click transaction. It often involves extra manual work, calls with payment processors, and careful tracking to make sure your money actually finds its way back to you. For a business, proper understanding payment reconciliation is crucial to prevent serious accounting errors and losses, especially in tricky cases like this.

The absolute biggest fear for any merchant is a chargeback. If a refund fails to get to a customer, it often turns into a payment dispute, which costs the business time and money to fight.

This isn't a small problem. Global chargeback volume is projected to jump by 24% between 2025 and 2028. On top of that, 57% of merchants report they're already seeing more refund abuse—where a customer gets a check, for example, but still disputes the original charge.

A single failed refund can quickly spiral into chargeback fees, lost revenue, bad reviews, and a customer who never comes back. Knowing the pressure merchants are under can help you communicate more patiently and effectively with them.

This challenge is especially common in crowdfunding. Long waits for fulfillment mean more backers will have cancelled or expired cards by the time products ship. Tools like PledgeBox are designed to help creators navigate this exact mess.

To put it simply, Kickstarter's pledge manager is like a marketplace (think Amazon), whereas the PledgeBox pledge manager is like Shopify—a powerful toolkit that puts creators in the driver's seat. The best part? PledgeBox is free to send the backer survey and only charges 3% of upsell if there's any, making it a risk-free way to manage those post-campaign details.

One of the trickiest parts of crowdfunding is just how long everything takes. Campaigns can run for months, and fulfillment can sometimes stretch into years. It's a long haul.

Because of this, a refund to a cancelled credit card isn't a rare occurrence—it's something most creators will face. Backers move, change banks, or get new cards with updated expiration dates long after they've made their initial pledge. When a refund is needed, things get complicated.

This is where a dedicated pledge manager becomes a creator's best friend. It takes all the post-campaign logistics off the crowdfunding platform and puts the control back in your hands, especially when it comes to messy payment situations.

Trying to navigate these payment hurdles without a flexible system is a recipe for a logistical headache. Using a specialized platform can mean the difference between a quick, easy resolution and a complete nightmare for both you and your backers.

Think of Kickstarter as the Amazon marketplace—it's a great place to showcase your idea and attract buyers. A pledge manager like PledgeBox is more like your own Shopify store. It’s a powerful toolkit that gives you direct control over your backer relationships, fulfillment details, and finances.

This difference is key. While Kickstarter is fantastic for gathering those initial pledges, a tool like PledgeBox is built to handle everything that comes after the campaign ends. For instance, PledgeBox is free to send the backer survey and only charges 3% of upsell if there's any. This model lets you manage your campaign without any scary upfront costs.

This allows creators to handle everything from simple address updates to the most complex refund scenarios. For more on navigating backer expectations, check out our guide on how to deal with backers canceling their pledges.

Getting a refund can feel complicated, especially when your original payment card is no longer active. Let's clear up some of the most common questions people have when trying to get a refund to a cancelled credit card.

Give it a little time. You should generally wait about 7-10 business days after the merchant confirms they’ve processed the refund. While electronic transfers are quick, rerouting money from a closed card account can add a few extra days to the timeline.

If two weeks go by and you still haven'tseen the money appear, that's your cue to pick up the phone. When you call your bank, have all the original transaction details ready to go—it will make the whole process much smoother.

This is where things get tricky. If both the credit card and the bank account it was tied to are closed, the refund has nowhere to go. The bank will simply reject the transaction, and the money will bounce right back to the merchant.

Your next move is to get in touch with the merchant directly. They’re still on the hook for getting you your money back, but they'll need to try a different route. Most will offer to mail you a paper check or set up a direct bank transfer to your new, active account.

Absolutely not. A merchant can't legally deny a valid refund just because your old card is out of the picture. They have a responsibility to find a reasonable way to return your money.

If the first attempt to refund you electronically fails, they have to offer an alternative. This could be store credit (which you are not obligated to accept), a paper check, or another payment method. If they dig their heels in and refuse to cooperate, you can always escalate the situation by filing a consumer complaint.

Managing refunds is one thing, but running a full-blown crowdfunding campaign brings its own set of challenges. For creators who need a powerful, flexible toolkit to handle all the post-campaign logistics, PledgeBox offers a seriously elegant solution. It helps you manage backer surveys, collect shipping fees, and even boost your revenue with upsells, all without the logistical headaches. See how you can streamline your next campaign at https://www.pledgebox.com.

The All-in-One Toolkit to Launch, Manage & Scale Your Kickstarter / Indiegogo Campaign